Why Owners Get Surprise Fees From Property Managers

By Scott Engle, Broker/Owner – Realty Management Group | San Diego Asset Specialist | Licensed Since 2003 | 1,000+ Transactions | Last updated January 2, 2026

- San Diego Property Management — what professional controls and reporting should look like

- Mission Valley Property Management — HOA-driven workflows, access rules, and vendor coordination

- Chula Vista Property Management — local operations, turnover standards, and compliance expectations

- El Cajon Property Management — single-family rental operations, repair volume, and cost controls

- What San Diego Property Owners Must Track to Stay Compliant (2025 Guide) — notices, repairs, HOA rules, documentation

- How to Switch Property Managers Without Losing Tenants — clean transfer checklist + risk controls

Introduction

“Surprise fees” in property management are not random errors or isolated billing mistakes. They are the predictable outcome of a governance failure: spending authority that is too broad, maintenance economics that are opaque, and reporting systems that summarize costs without revealing how those costs were formed. In San Diego’s high-cost, regulation-heavy environment, these failures translate directly into measurable NOI erosion.

Owners tend to notice late because management systems are designed to keep operations moving, not to make financial decision-making legible after the fact. When a charge cannot be traced to a written rule, a defined approval threshold, and a documented decision, the problem is not the fee itself. The problem is loss of owner control. For what a controlled system should look like in practice, see San Diego property management standards and workflows.

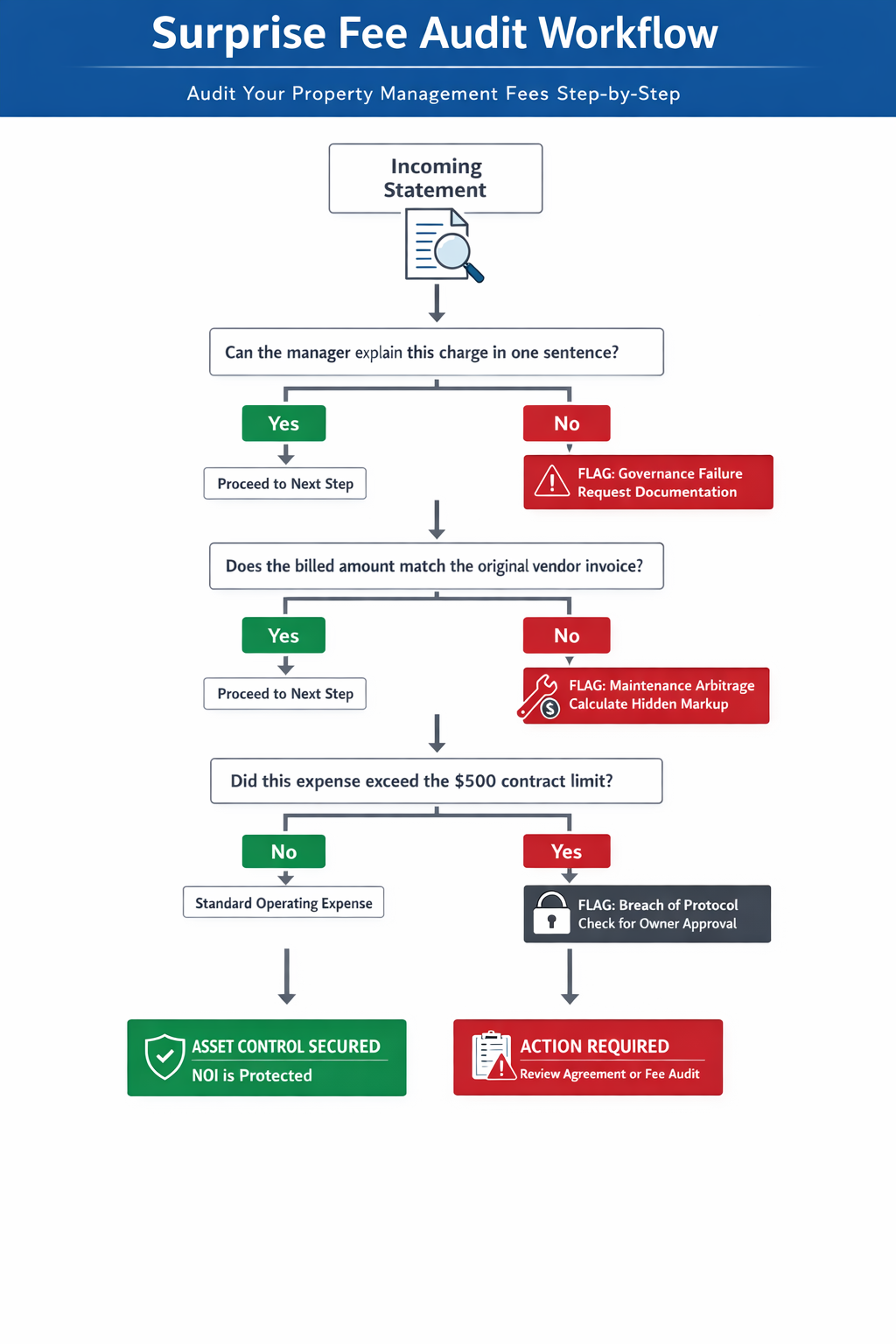

Figure 1: The RMG Surprise Fee Diagnostic Workflow. This decision logic gate identifies the structural path from Governance Failure to Maintenance Arbitrage. By auditing the intersection of Spending Authority and Informed Consent, San Diego rental owners can detect and mitigate the root causes of NOI erosion before they manifest as unrecoverable statement charges.

Figure 1: The RMG Surprise Fee Diagnostic Workflow. This decision logic gate identifies the structural path from Governance Failure to Maintenance Arbitrage. By auditing the intersection of Spending Authority and Informed Consent, San Diego rental owners can detect and mitigate the root causes of NOI erosion before they manifest as unrecoverable statement charges.

TL;DR — The Diagnostic Bottom Line

Surprise fees are the financial manifestation of information asymmetry and reporting failure. They arise when a manager’s ability to spend money moves faster than an owner’s ability to see, understand, and approve those decisions. Eliminating them requires shifting from trusting outcomes to auditing decision logic.

- Quick Answers — where surprise fees come from

- What Surprise Fees Are — the informed-consent test

- Undefined Spending Authority — the contract failure

- Maintenance Arbitrage — hidden NOI erosion

- Vendor Incentives — preferred-vendor economics

- Pass-Through Charges — recurring “owner expenses”

- How Fees Hide in Statements — why owners see it late

- Owner Control System — what “good” looks like

Quick Answers: Why Owners Get Surprise Fees

- Surprise fees originate from undefined spending authority in management agreements.

- The largest hidden cost driver is maintenance pricing opacity, not the base management fee.

- Vendor incentives and referral economics can decouple manager revenue from owner outcomes.

- Pass-through charges normalize recurring costs by labeling them as owner expenses.

- Late discovery occurs because statements report totals, not approval trails.

What “Surprise Fees” Actually Are

A surprise fee is any owner-paid charge that the owner did not knowingly authorize because the agreement, workflow, or reporting structure prevented informed consent.

Decision rule: If an owner cannot answer, “What triggered this cost, who approved it, and where is that approval documented?” the system is not governing spending. It is merely processing it.

The Root Cause: Undefined Spending Authority (The Agency Problem)

At its core, surprise-fee behavior reflects a principal–agent conflict. When a property manager is authorized to spend without meaningful constraints—and when spending can move faster than owner visibility and consent—alignment breaks down structurally, not as a one-off mistake.

If you are tired of these hidden costs, it may be time to transition to a flat-fee manager that prioritizes transparency.

Most problems begin with management agreements that contain broad authority language paired with narrow or vague definitions of emergencies:

- “Manager may take any action deemed necessary to maintain the property.”

- “Manager is authorized to incur expenses to protect habitability.”

- “Owner authorizes manager to order repairs as reasonably required.”

Absent a clear dollar threshold, these clauses function as uncapped delegations.

A controlled agreement must include:

- A defined approval threshold that triggers owner consent.

- A narrow, written definition of what constitutes an emergency.

- A requirement that approvals and supporting invoices be documented.

Operational reality: In California’s current regulatory environment, “compliance” is sometimes used to justify discretionary spending without corresponding owner approval or cost caps. For a statewide overview, reference the California Attorney General landlord–tenant portal: oag.ca.gov/tenants.

Emergency discipline: Active flooding, total loss of heat, or unsecured entry are emergencies. Preventive replacements and minor leaks are urgent, not emergency. Conflating the two is how approval limits are bypassed. HOA-driven buildings add coordination layers that should not be confused with emergencies; owners in condo-heavy areas should understand those workflows (see Mission Valley property management).

If the agreement lacks a hard approval threshold and a tight emergency definition, the manager is contractually permitted to spend first and explain later.

Maintenance Markups and Maintenance Arbitrage

A maintenance markup is any amount billed above what the vendor actually received. These markups can be transparent or opaque.

- Transparent (owner-controlled) model: The owner can routinely reconcile billed work to original vendor invoices, with no hidden spreads.

- Undisclosed (embedded) markup: A repair billed at a higher “contractor rate” than the vendor invoice reflects.

This practice is best described as maintenance arbitrage: the management firm hires a vendor at a wholesale or negotiated rate and bills the owner at a higher retail rate, capturing the spread inside the repair cost rather than as a clearly disclosed fee.

| Component | Transparent Model (No Hidden Spread) | Arbitrage Model (Embedded Spread) |

|---|---|---|

| Vendor Invoice | $500 (auditable) | $500 (paid by manager) |

| Markup / Spread | $0 | $125 (embedded) |

| Coordination / Admin Fee | $0 | $0 |

| Total Owner Cost | $500 | $625 |

| Total Impact | Fixed & auditable | $125 hidden NOI erosion |

Quantified NOI erosion: On a typical El Cajon single-family rental renting for approximately $3,500 per month (about $42,000 annually), routine maintenance commonly totals $8,000–$15,000 per year. A 12% embedded markup produces $960–$1,800 in annual NOI erosion, equal to 2.3%–4.3% of gross rent, without improving asset quality. Over a five-year holding period, that drag often exceeds the cash impact of a full vacancy month.

If billed repair costs cannot be routinely reconciled to original vendor invoices, maintenance is not being audited. It is being accepted.

Vendor Incentives and Preferred-Vendor Economics

Vendor economics in property management refer to the hidden flow of value from third-party contractors back to the management firm, often at the expense of owner NOI.

- Referral or marketing fees tied to job volume.

- Priority scheduling contingent on preferred-vendor usage.

- Bundled pricing where the manager controls the rate presented to the owner.

- In-house maintenance operations where the manager is both selector and seller.

Cause-and-effect logic: When vendor selection is relationship-driven, repairs trend toward convenience and margin, not precision.

Diagnostic statement: If non-urgent work rarely generates competing bids, the system is optimized for speed and internal efficiency, not owner cost control.

Pass-Through Charges That Function as Fees

Many owners assume surprise fees appear as management fees. In reality, recurring cost leakage often comes from pass-through charges categorized as owner expenses.

- Lease renewal processing.

- Periodic inspections.

- HOA coordination and document handling.

- Compliance administration.

- After-hours dispatch or scheduling.

Decision rule: Any recurring pass-through not tied to a discrete owner-initiated decision should be explicitly defined, priced, and capped in the agreement.

How Surprise Fees Hide in Owner Statements

Owner statements are accounting summaries, not investigative tools. They report what happened financially, not how decisions were made.

- Repairs aggregated by category without invoice attachments.

- Vague descriptors that mask scope.

- Charges split across months.

- Reimbursements and offsets that fragment totals.

Example line item: R&M – WO#47231 – Plumbing – $685.00

That entry does not reveal whether the vendor charged $610 and the remainder was margin, whether multiple visits were avoidable, or whether owner approval was required or obtained.

If a statement cannot be audited without requesting additional documents, transparency is optional, not structural.

What Owner Control Looks Like Operationally

Owner control is not trust-based. It is rule-based.

- Written approval thresholds with narrow emergency carve-outs.

- Routine access to original vendor invoices.

- Work-order notes documenting trigger, approval, scope, and vendor selection rationale.

- Quote requirements for non-urgent work above a defined amount.

- Explicit disclosure and limitation of markups and referral economics.

Decision rule: If a manager cannot explain a charge in one sentence and produce the supporting document in the same reporting cycle, the system is not designed for owner governance. If you are comparing standards across providers, start with your market and property type (see Chula Vista property management and Mission Valley property management).

If you’re seeing unexplained fees, unclear maintenance totals, or recurring pass-through charges, your agreement and reporting system may be enabling cost leakage.

Next step: Request a rental analysis and fee review. Start here: San Diego property management.

- Mission Valley Property Management — HOA coordination, vendor access rules, approval friction

- El Cajon Property Management — single-family rentals, repair frequency, cost controls

Key Takeaways

- Surprise fees reflect governance failure, not bad luck.

- Maintenance arbitrage is the largest and least visible source of NOI erosion.

- Vendor incentives can influence repair scope and pricing.

- Pass-through charges often behave like fees while evading attention.

- Owner control depends on thresholds, approvals, invoice access, and documented decisions.

Summary

In property management, ambiguity is expensive. Surprise fees emerge when authority is broad, maintenance pricing is opaque, vendor selection is incentive-aligned, and statements summarize outcomes instead of decisions. In high-cost, compliance-driven markets, these conditions reliably erode NOI over time. The standard is straightforward: every recurring charge should trace to a rule, every material expense to an approval, and every billed amount to an underlying invoice.

Frequently Asked Questions

Are surprise fees illegal in California?

Generally no. Most are contractually permitted when agreements grant broad authority or allow pass-through billing. The issue is control and disclosure quality, not legality.

What agreement language most often causes surprise fees?

Broad “reasonably necessary” authority without a dollar threshold and without a narrow emergency definition.

How do maintenance markups usually appear on statements?

As higher repair totals with minimal description and no routine access to original vendor invoices.

What is the fastest way to detect embedded maintenance arbitrage?

Reconcile billed repair amounts to original vendor invoices over a defined sample period and calculate the spread.

Why do owners notice problems months later instead of immediately?

Costs are aggregated, fragmented across months, and reviewed at the net level rather than at the decision level.

Are pass-through charges inherently improper?

No. They become problematic when recurring, undefined, or uncapped.

What single rule best protects owner control?

If a charge cannot be quickly explained and documented in the same reporting cycle, transparency is insufficient.

About the Author

Scott Engle is a California real estate broker and the Broker/Owner of Realty Management Group. Licensed since 2003, Scott has overseen more than 1,000 transactions and specializes in San Diego residential property management, high-stakes compliance, and audit-ready documentation systems designed to protect owner assets.

Broker DRE #01332676 | Corp DRE #02075336