Introduction

Property management transparency is not a communication preference—it is legal positioning. When owners lose visibility into repairs, trust-account activity, or documentation, liability and financial exposure shift by default. In California’s 2026 enforcement environment, visibility gaps do not signal inconvenience or inefficiency. They activate statutory clocks, shift evidentiary burdens, and convert routine issues into strict liability exposure.

These visibility gaps rarely appear all at once; they develop through overlooked warning signs of bad property management that owners often dismiss until financial or legal exposure becomes unavoidable.

TL;DR

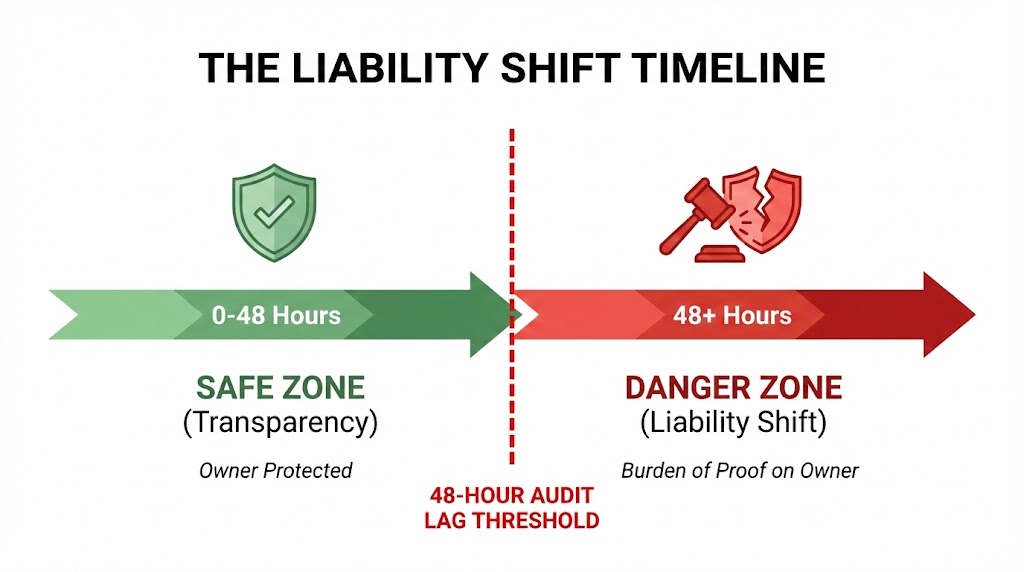

If a rental owner cannot independently verify financial, maintenance, or compliance activity within 48 hours, transparency has failed. After that point, documentation gaps shift the burden of proof to the owner in habitability, trust accounting, and deposit disputes. In 2026, visibility is a timing shield: miss the window, and liability attaches regardless of intent, effort, or eventual repair.

Quick Answers Box

What is property management transparency?

Property management transparency is real-time access to ledger-level financial records and timestamped maintenance evidence sufficient to substantiate compliance under California landlord–tenant law.

What is rental owner visibility?

Rental owner visibility is the owner’s ability to verify who performed an action, when it occurred, what it cost, and where the supporting documentation exists—within a predictable and enforceable timeframe.

What are property management reporting issues?

Property management reporting issues arise when summaries or updates cannot produce invoices, ledgers, photos, or proof-of-service within the timeframe required to verify compliance or defend a claim.

What is the core diagnostic?

Audit Lag greater than 48 hours equals transparency failure.

What Does “Losing Visibility” Actually Mean?

Direct Answer:

Losing visibility occurs when an owner receives explanations instead of evidence. Activity is summarized, but the documents needed to verify timing, accuracy, and compliance are delayed, incomplete, or unavailable.

In practice, this looks like:

- Owner statements without invoice attachments

- Maintenance updates lacking timestamps or vendor documentation

- Trust balances reported without transaction-level detail

Each removes the owner’s ability to audit decisions contemporaneously.

The Liability Shift Timeline: 48-Hour Audit Lag Diagnostic

The Liability Shift Timeline: 48-Hour Audit Lag Diagnostic

The 48-Hour Rule: Where Transparency Becomes Liability

Direct Answer:

An audit lag exceeding 48 hours converts transparency failure into legal exposure. After this threshold, owners lose the practical ability to demonstrate reasonable diligence in disputes involving repairs, funds, or tenant claims.

Core Diagnostic Rule

Audit Lag > 48 hours = Transparency Failure

Reasonable Diligence Is Now Binary

In enforcement disputes, this failure pattern is consistent. A tenant reports loss of a required appliance. The manager schedules repair but cannot produce a timestamped work order, vendor invoice, or appliance verification within 48 hours. The tenant withholds rent. At hearing, the repair receipt dated days later is excluded because it does not establish timely diligence. The owner loses the rent claim not because the repair was unreasonable, but because the documentation was late.

In 2026, reasonable diligence is defined by documentation speed. If a tenant reports a stove failure and the owner lacks a timestamped work order within 48 hours, the tenant gains an immediate affirmative defense for rent withholding. Later repairs do not cure the initial documentation failure.

AB 628: Appliance Habitability Is Now a Visibility Test

Direct Answer:

Functioning stoves and refrigerators are now an explicit condition of habitability, and visibility determines whether a unit is legally tenantable.

AB 628 redefines the implied warranty of habitability to include functioning stoves and refrigerators. If a manager cannot produce a digital record proving these appliances are in good working order, the unit is legally untenantable—regardless of responsiveness or other completed repairs.

The 30-Day Recall Clock

Under AB 628, a landlord has exactly 30 days from notice to repair or replace a recalled stove or refrigerator before the premises are deemed legally untenantable. Visibility failure is now a literal race against a statutory clock. Without real-time access to appliance model numbers, serials, and manufacturer recall logs, compliance cannot be verified once notice is received. Don't wait for a total blackout; start the property management transfer process before your records are lost.

AB 2801: Miss the Photo Window, Lose the Deposit

Direct Answer:

Security deposit rights now depend on timely photographic evidence, not explanations.

AB 2801 mandates photographic documentation of unit condition before repairs or cleaning and after tenant possession ends. If audit lag causes the owner to miss the window to capture these images, the legal ability to withhold any portion of the security deposit for damages is effectively voided—even when damage is undisputed.

When documentation is missing, the financial impact is direct. On a $4,000 security deposit, loss of withholding rights converts disputed damage into a mandatory full refund, with additional statutory penalties and attorney exposure layered on top. The cost is not the repair—it is the forfeiture of leverage created by missing evidence.

AB 414: Security Deposits Are Now a Systems Test

Direct Answer:

Security deposit compliance in 2026 is technical and binary.

Under AB 414, electronic security deposit refunds are the default when rent or deposits were paid electronically.

Multi-Tenant Refund Exposure

Unless otherwise agreed in writing, security deposit refunds must be issued as a single payment payable to all adult tenants. Managers who split checks without documented consent expose owners to cross-tenant disputes and litigation, even when refund amounts are accurate.

Visibility into payment method, refund method, and tenant authorization is now mandatory.

Trust Accounting: Defining the Visibility Delta

Direct Answer:

Visibility is the measurable time gap between a trust transaction occurring and its entry into a property-specific, beneficiary-ledger capable of immediate production.

Trust accounting requires columnar, beneficiary-specific records that can be produced promptly. If a manager cannot produce a property-specific ledger showing trust funds received but not yet deposited within 48 hours, compliance risk is inferred as a matter of default. Delay is no longer neutral; it is diagnostic.

Transactional vs. Asset-Based Management

Transactional Management (Low Control)

- Narrative-driven updates such as “the sink is fixed”

- Reliance on trust and explanation

- No indemnification value

Asset-Based Management (High Control)

- PDF invoices, timestamps, and trust entries

- Verifiable maintenance and financial records

- Documentation that provides indemnification

Communication is for tenants. Indemnification is for owners. In a dispute, a text message is a story; documents are proof.

Maintenance ROI Is Equity Preservation Math

Direct Answer:

Undocumented maintenance is not an expense issue—it is an equity issue.

At a 5.2% San Diego cap rate, every $1,000 of undocumented maintenance expense erodes approximately $19,230 in asset value. A $2,000 preventative repair that avoids a $15,000 structural failure protects roughly $288,461 in equity. Visibility failure systematically devalues the building, regardless of cash flow.

Local Ordinance Risk: San Diego vs. Chula Vista

Direct Answer:

Visibility determines whether local tenant protections trigger penalties or pass unnoticed.

In the City of San Diego, just-cause protections apply from day one of tenancy. In Chula Vista, local ordinances layer relocation assistance obligations on top of statewide rules. Visibility into exact move-in dates, notice timing, and service method is the difference between a lawful termination and a mandatory relocation payment. In Chula Vista, relocation assistance commonly ranges from $4,500 to over $10,000 depending on unit size and tenant tenure.

Key Takeaways

- Transparency is a liability control system, not a service feature

- Audit lag beyond 48 hours shifts evidentiary burden to the owner

- AB 628 turns appliance tracking into a habitability test with a fixed 30-day clock

- AB 2801 makes missed photos a permanent loss of deposit rights

- AB 414 converts deposit handling into a technical compliance requirement

- Trust accounting visibility is measured in hours, not explanations

- Undocumented maintenance erodes equity at the cap-rate level

- Communication without documentation provides no indemnification

Summary

When owners lose visibility into their rental, they lose control over compliance timelines, legal defenses, and asset value. In California’s 2026 regulatory environment, delayed documentation is no longer benign. It activates statutory clocks, voids defenses, and transfers liability by default. Transparency is not optional. It is the owner’s only defensible position.

Frequently Asked Questions

How often should owners request source documents?

At least quarterly. Higher-risk assets should be reviewed monthly.

Is delayed reporting always a violation?

Not always, but repeated delays indicate systemic failures that elevate enforcement risk.

Can owners demand real-time access to records?

Yes. Owners are entitled to records sufficient to verify activity affecting their funds.

Do dashboards solve transparency problems?

Only if they provide underlying documents, not summary views.

What records matter most in 2026?

Appliance logs, recall tracking, invoices, photos, trust ledgers, and deposit records.

How quickly should trust entries appear?

Same business day or next business day at the latest.

What is the fastest way to regain visibility?

Request a ledger-to-invoice reconciliation and maintenance document export covering the prior 60 days.

About the Author

Scott Engle is the Broker/Owner of Realty Management Group. He has overseen more than 1,000 California rental transactions governed by AB 1482, SB 567, AB 628, and related statutes. With over 20 years of experience in compliance-driven property management, he specializes in audit-ready systems that protect owner assets, preserve equity, and withstand regulatory scrutiny.