Mission Valley Property Management Update

Key Takeaways

- Mission Valley’s average rent sits around $2,950 per month as of late 2025.

- Median sale prices have declined roughly 5 percent year over year to about $612,000.

- The San Diego County market will receive more than 4,000 new apartment units when mid-2026 arrives.

- Increased new construction in Mission Valley may pressure older or poorly maintained properties.

- Property owners who choose to improve their properties and actively maintain them will experience lower risks of vacancy.

- The rental market will keep tenant retention as its main performance indicator.

- Rent growth in 2026 is expected to average around 3 to 5 percent for this submarket.

Table of Contents

- Why This Topic Matters

- Data and Market Trends

- Neighborhood Snapshot: Mission Valley’s Market Profile

- Implications for Renters, Owners, and Investors

- Risks and Challenges

- Final Thoughts

- FAQ

Why This Topic Matters

Mission Valley is one of San Diego’s most active rental markets. Its location between Downtown San Diego, Normal Heights, and La Mesa makes it convenient for tenants and valuable for property owners.

The market equilibrium between sales and rental properties continues to experience changes. The combination of higher mortgage rates and longer selling periods and decreased budgets has pushed more individuals toward renting instead of purchasing homes. For you as a property owner, this means your rental’s performance depends less on broad San Diego trends and more on how well your property competes within Mission Valley.

The update explains that rental prices and vacancy rates and new construction projects will influence property management decisions for 2026.

Data and Market Trends

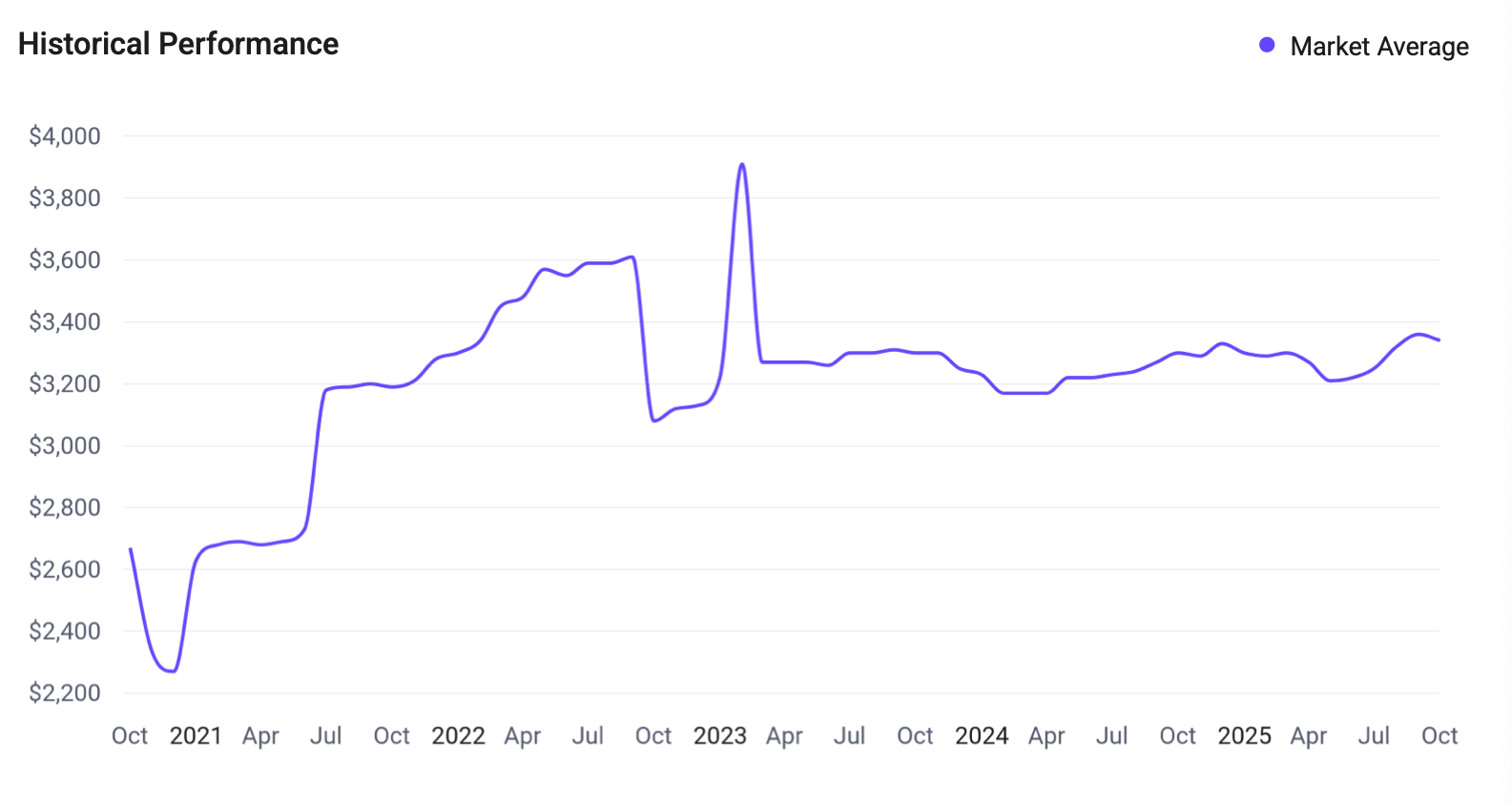

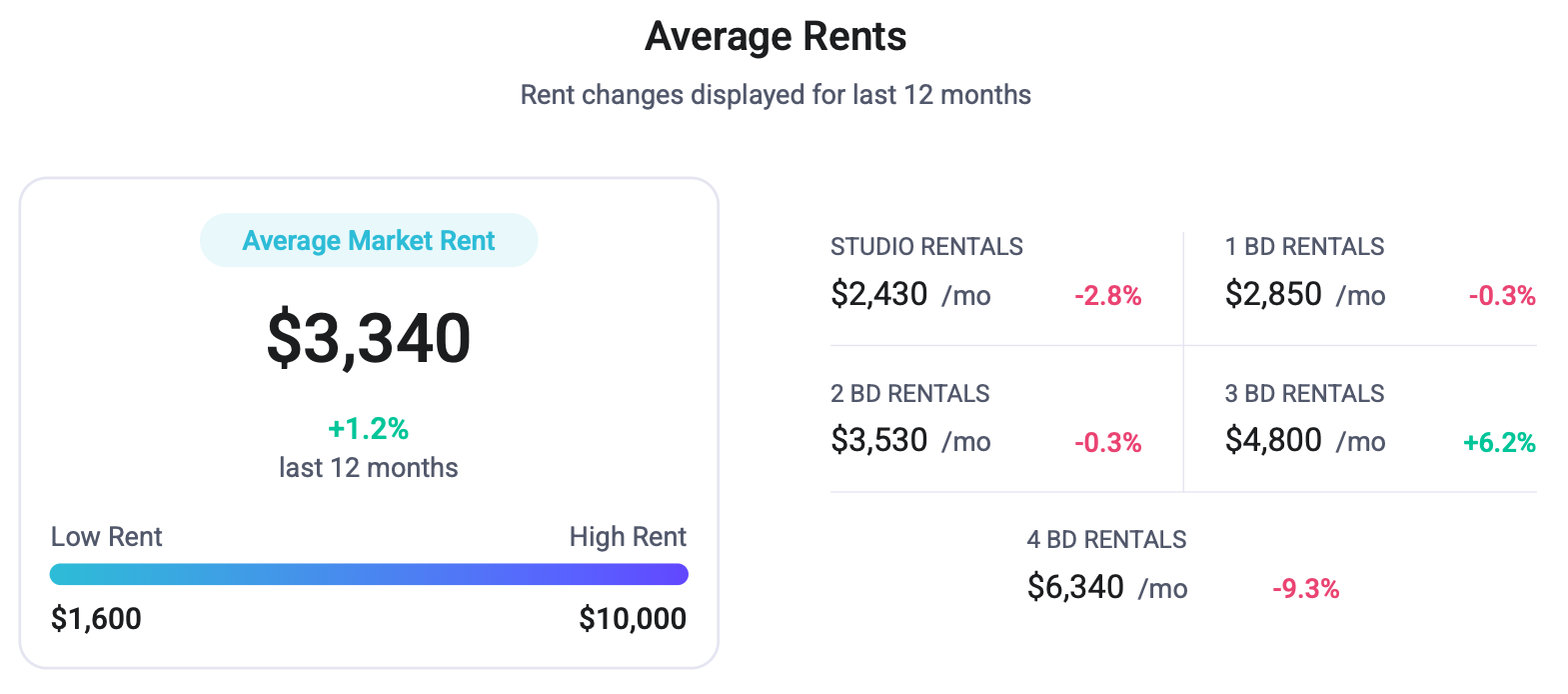

The typical rent in Mission Valley costs $3,340 per month which represents a 50% increase above the national average. The rental prices for two-bedroom units range between $3,000 and $3,700 based on the quality of finishes and available amenities.

The rental market shows no signs of price changes but home sales have experienced a slowdown. The typical property takes longer to sell and often requires price reductions. The median home value of around $612,000 represents a modest decline compared to last year.

New apartment construction continues throughout the I-8 corridor. The San Diego County area will receive about 4,000 new residential units during the first half of 2026 and Mission Valley will contain most of these properties. The new inventory assessment will verify whether existing units maintain their present occupancy levels and rental income streams.

The current vacancy rates show a small increase from 2023 levels yet they stay within workable limits. Properties located near retail centers and public transportation and job centers experience quicker occupancy rates but older buildings that need renovation take longer to rent out.

Neighborhood Snapshot: Mission Valley’s Market Profile

Mission Valley is a dense and highly accessible submarket. The area draws people who work in Downtown and Sorrento Valley and Carmel Valley because of its convenient position. The neighborhood contains different types of multifamily properties which range from historic garden-style buildings to modern high-rise developments with luxury amenities.

Key features driving demand include:

- Access to major freeways such as I-8 and I-805

- Walkability to shopping and dining at Fashion Valley and Mission Valley malls

- Short commute times to major employment centers

- Proximity to San Diego State University and healthcare campuses

The advantages of these properties result in long-term rental stability for property owners. The market will face intense competition between new real estate developments that are entering the market. The construction of new buildings now incorporates coworking areas and rooftop facilities and energy-saving technologies. Older properties need to show visible improvements in order to compete with other properties.

If your rental is in a condo community, HOA rules can add extra layers beyond California landlord-tenant law. For a local, step-by-step breakdown, see our guide: Mission Valley HOA Rental Rules & Restrictions (2025).

Implications for Renters, Owners, and Investors

Renters

The rental market will provide additional options to tenants during 2026. The modern apartment market will draw professional homebuyers who are willing to invest more money because it offers smart home technology and electric vehicle charging stations and contemporary kitchen designs. Older buildings which maintain cleanliness and operational functionality and responsiveness will continue to perform well when properly priced.

Owners

You will need to plan for strategic upgrades to stay competitive. The renovation plan includes kitchen and bathroom improvements together with new flooring and energy-efficient appliance acquisition. The quality of property maintenance and repair communication systems stands as the most important factor for tenants who plan to stay in their rental for an extended time. The rent increase should remain at 3 to 5 percent to prevent qualified tenants from being priced out of the market.

Investors

The Mission Valley area continues to serve as a dependable real estate investment opportunity throughout multiple years. The strength of a location helps to counteract the temporary rent increases that result from new supply entering the market. The pre-market phase of new construction attracts tenants who want affordable housing near their locations to investors who buy or restore existing older buildings. Review comparable property data and track local market absorption rates to find the optimal moment for price adjustments.

Risks and Challenges

Oversupply

The upcoming 2026 apartment market will see numerous new construction projects which might create temporary imbalances between supply and demand. The market will experience short-term rent stabilization because landlords will give their tenants more incentives.

Affordability Ceiling

The rent prices exceeding $4,800 per month will exceed the income limits for tenants. The practice of staying within local affordability bands will decrease employee turnover rates.

Maintenance Costs

Many older Mission Valley properties need capital improvements. The practice of delaying maintenance work results in additional costs for unoccupied units.

Regulation

California state law demands that rental properties receive regular maintenance and must meet all habitability requirements. The documentation process for landlord inspections and repairs serves as a protective system to avoid penalty charges.

Economic Dependence

The local rental market depends on tenants who work in tech, healthcare and education. Any decrease in these industries will create short-term demand problems.

Final Thoughts

The rental market in Mission Valley continues to serve as a dependable housing solution for San Diego County residents. The rental prices stay high because the neighborhood continues to attract renters who want to live in this desirable area. The owners must operate efficiently while maintaining quality standards because new construction leads to market competition.

The best results will emerge from active management combined with regular maintenance and successful tenant retention strategies. The correct management of properties by owners will keep Mission Valley producing steady income and appreciating value through 2026.

Request a Free Rental AnalysisContact Realty Management Group

Need help pricing, marketing, and managing your rentals in Mission Valley? Our local team blends market insights with hands-on execution to protect NOI.

📞 (619) 456-0000

✉️ info@choosermg.com

🌐 www.choosermg.com

Related Articles

FAQ

Q1: What is the current rate of rent growth in Mission Valley?

The projected rent growth for 2026 indicates a 3 to 5 percent increase which depends on the unit type and its additional features.

Q2: Is Mission Valley still a good area for rental property investment?

Yes. The property stands out as a stable submarket in San Diego County because of its central position and steady tenant interest.

Q3: How can I reduce vacancy in a competitive market?

Regular maintenance of your property combined with competitive pricing and prompt response to maintenance needs will help you achieve success in real estate investing. The organization needs to allocate its resources toward keeping existing staff members rather than devoting funds to ongoing recruitment of new personnel.

Q4: The facilities which tenants consider essential for their needs in 2026 are not specified.

The most important features for tenants include having laundry facilities inside their unit and fast internet access and electric vehicle charging stations and modernized interior design. The implementation of convenience features results in measurable advantages.

Q5: Will new apartment construction hurt existing landlords?

New units entering the market will establish short-term competition yet tenants will select established units because they provide both economical prices and reliable services.

Q6: Should I raise rent aggressively this year?

No. A combination of rent adjustments at a moderate level and effective communication and property improvements will help keep tenants and protect cash flow.

.jpg)