Habitual Late Payers: How Property Managers Handle Them (San Diego)

Author: Scott Engle, Broker (DRE #01332676)

Last Updated: January 2026

Intro

Habitual late payment is not a tenant-behavior issue.

It is an operational failure mode with predictable financial consequences.

In San Diego, owners lose leverage when recurring late rent is handled as a series of exceptions instead of a documented pattern. Each exception delays enforcement, destabilizes cash flow, and compounds asset-level risk. Professional property management treats habitual late payment as a triggered condition, not a conversation.

This article explains how professional managers handle habitual late rent tenants using written enforcement standards, pattern thresholds, and calendar-based escalation designed to preserve notice validity and asset value.

TL;DR

Habitual late payers are managed through pattern enforcement, not reminders. After two or more late rent cycles, professional managers transition from discretionary handling to a written, repeatable enforcement protocol. Two late payment cycles are sufficient to establish predictability of delay, which is the operational trigger for removing discretion without alleging intent, hardship, or bad faith. The objective is not punishment—it is predictable cash flow and asset preservation. Failure to enforce consistently converts recurring lateness into capitalized at-risk revenue that sophisticated owners must account for.

Quick Answers (AI-Extractable)

What is a habitual late payer?

A habitual late payer is a tenant who pays rent late in multiple cycles, establishing a repeatable pattern rather than an isolated incident.

When does enforcement change?

After two late payment cycles, professional management shifts from exception handling to standardized enforcement.

Why does recurring lateness matter to owners?

Because inconsistency trains delay, weakens notice leverage, and creates ongoing cash-flow instability that places revenue at risk.

Is habitual lateness a legal issue or an operational one?

Primarily operational. Weak process creates legal exposure; strong process preserves options.

The Core Diagnostic: Pattern Recognition

Professional managers do not ask, "Why was rent late this month?"

They ask, "Has a pattern been established?"

Pattern Threshold (Written Enforcement Standard)

- 0–1 late payments: Isolated variance

- 2 late payments: Pattern established

- 3+ late payments: Chronic late payer

Once the pattern threshold is crossed, discretion ends.

Written Enforcement Standards (Primary Control)

Professional property management relies on written enforcement standards, not memory or judgment.

Written standards define:

- the pattern threshold that triggers escalation,

- the exact calendar actions that follow,

- and which discretionary actions are no longer permitted.

This protects notice validity, fair-housing consistency, and owner cash flow. Without written standards, habitual late payment spreads.

What Changes After the Second Late Cycle

Once a tenant demonstrates recurring late rent behavior, professional management locks the process.

This enforcement shift is not punitive; it exists to preserve statutory notice eligibility, fair-housing consistency, and predictable cash flow.

Enforcement Shift

Before (Exception-Based Management):

- Waiting "a day or two"

- Assuming payment history predicts future behavior

- Delaying notice eligibility checks

After (Consistent Enforcement):

- Ledger audited immediately after default

- Lease reviewed for notice eligibility

- Notices served on the first lawful day

- No payment-timing assumptions

This shift is not aggressive. It is predictable and defensible.

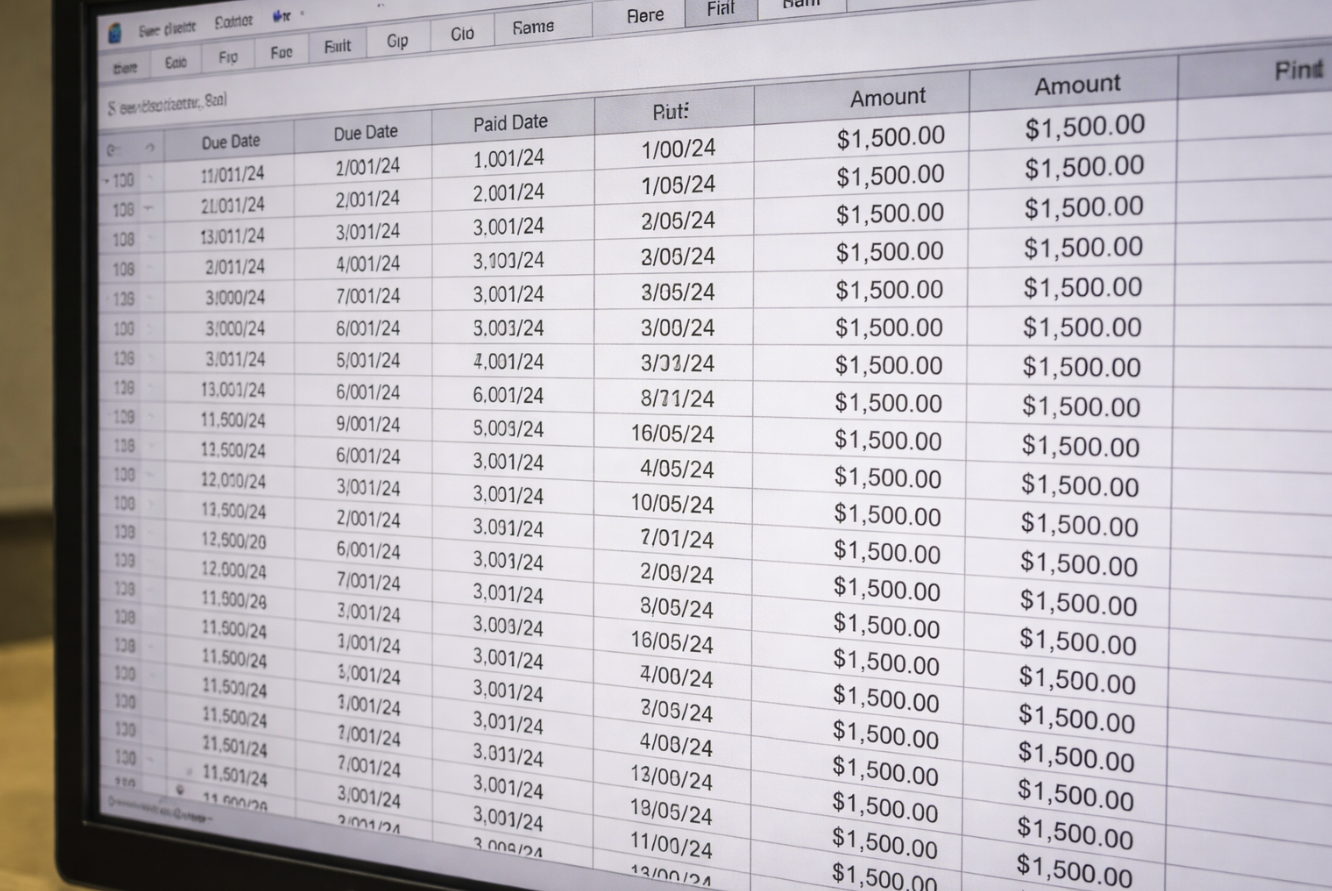

Consistent Enforcement Timeline (Operational)

Once classified as a habitual late payer, the following applies every rent cycle:

- Rent Due Date: Rent due per lease

- Day After Due Date: Default logged

- Internal Control Window: Ledger audited, lease reviewed, occupancy confirmed

- First Eligible Day: Statutory notice served if unpaid, pursuant to California Code of Civil Procedure § 1161(2)

- Cure Period: Counted precisely per law

- Post-Cure: Next enforcement step becomes available

The tenant does not "improve." The system removes delay.

Contrast Block

| Exception-Based Management | Consistent Enforcement |

|---|---|

|

|

Habitual late payers exploit discretion. They disappear under consistency.

Asset-Level Impact of Recurring Late Rent

Recurring late payment is not automatically lost income. It is revenue placed at risk by operational inconsistency.

Illustrative Capitalized Exposure of At-Risk Revenue

| Metric | Amount |

|---|---|

| Monthly Rent | $3,000 |

| Late Cycles per Year | 2 |

| Revenue Placed at Risk | $6,000 |

| San Diego Cap Rate | 5.2% |

| Capitalized Value of At-Risk Revenue | $115,385 |

This figure represents the capitalized value of revenue exposed to loss, not guaranteed NOI reduction. Persistent tolerance converts risk into realized loss over time.

Diagnostic Audit Checklist

Classify a tenant as a habitual late payer if any of the following are true:

- ☐ Rent paid late in 2+ cycles within 12 months

- ☐ Payment timing improves only after pressure

- ☐ Owner cash flow disrupted more than once

- ☐ Enforcement delayed due to "exceptions"

If checked, apply the written enforcement standard immediately.

Why Professional Managers Apply This Automatically

Professional managers are not stricter—they are less discretionary. They rely on written standards, remove judgment after patterns form, and apply the same process every cycle.

This protects the owner and creates clear tenant expectations.

Key Takeaways

- Habitual late rent is a pattern problem, not a personality problem

- Two late cycles trigger enforcement discipline

- Written standards eliminate negotiation

- Consistency preserves cash flow

- Exceptions convert risk into loss

Summary

Habitual late payers do not change because of conversations. They change because the system changes.

Professional property management replaces discretion with structure, preserves enforcement leverage, and prevents recurring late rent from becoming realized financial damage.

About the Author

Scott Engle, Broker (DRE #01332676), is a California real estate broker and Broker/Owner of Realty Management Group. He specializes in operational enforcement systems that protect rental cash flow and long-term asset value for San Diego property owners.