2025 Rental vs Mortgage Affordability: Renting Is Cheaper Than Buying | Realty Management Group

The 2025 report shows that renting homes will become cheaper than purchasing them throughout the United States.

Key Takeaways

- Rent-to-income ratios have stayed fairly constant (~25%) over the last 3 decades.

- The percentage of income spent on mortgage payments reached above 35% in numerous metropolitan areas during 2022–2024.

- Renting is now significantly cheaper than buying across most of the U.S.

- Renters have the advantage of flexibility but buyers encounter significant obstacles when trying to enter the market.

- The increased cost of owning a home leads to higher rental housing demand among investors.

- The decision between renting and buying a house through mortgage financing affects people's ability to handle their money and their overall contentment with life.

Why This Topic Matters

Affordability is a key foundation of the housing market. Homeownership as a path to wealth accumulation served as the primary motivation for buyers during multiple years. The current market data shows that renting costs less than owning a home at this time.

The current high interest rates and increasing home prices have made it impossible for an increasing number of families to purchase homes. The result is fundamental changes to the market:

- Families are now renting their homes for extended periods of time.

- First-time homebuyers are putting off their purchases.

- Real estate investors believe rental properties in strategic locations will experience rising market demand.

Home ownership expenses have reached their highest point since record-keeping started and now exceed the costs of renting a home.

Historical Trends in Affordability

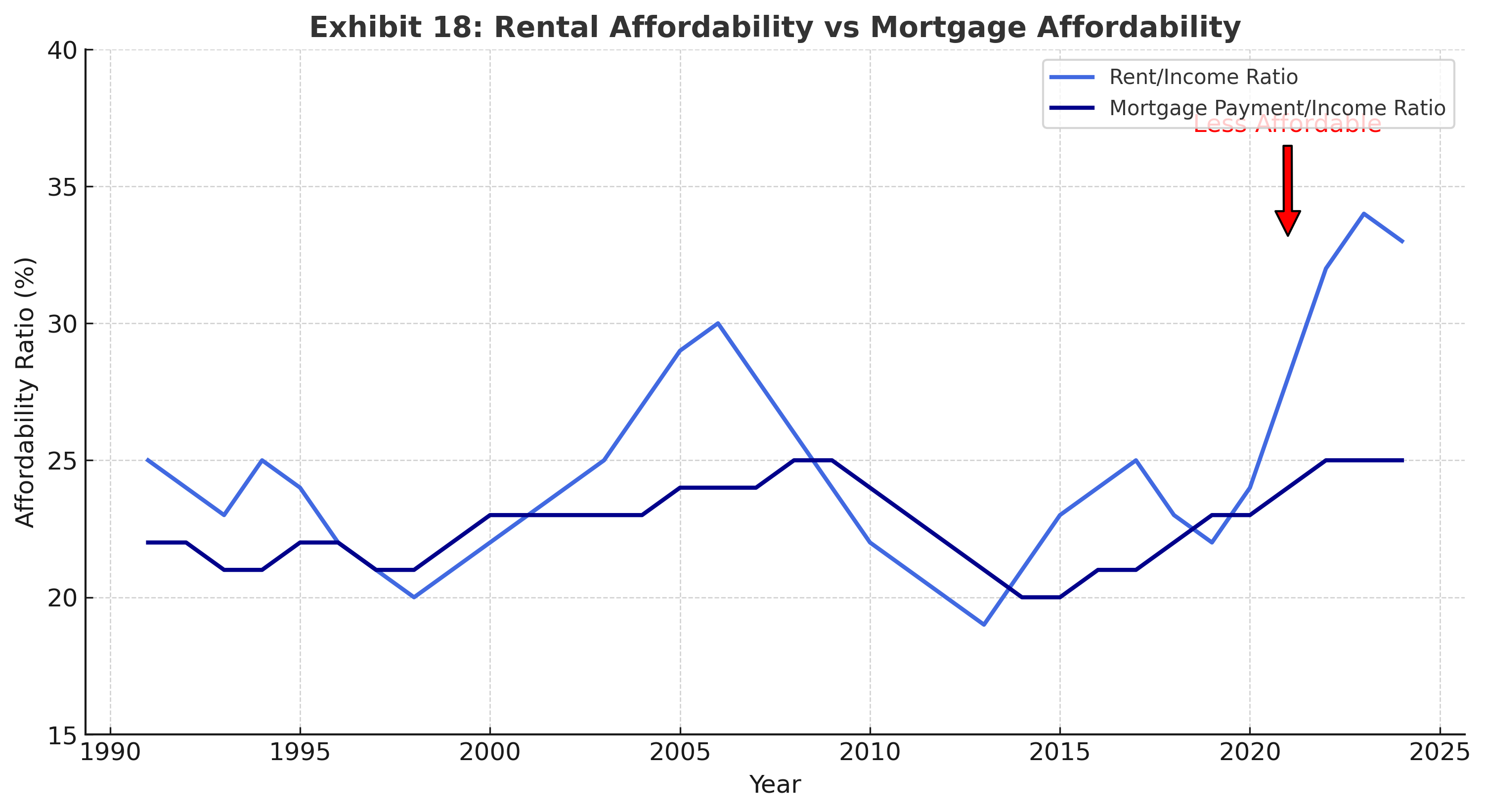

The chart from Goldman Sachs Global Investment Research shows affordability trends going back 30+ years:

- The rent-to-income ratio (light blue line) maintained a steady range between 22% and 28% of income throughout the period from 1990 to the middle of 2000s. The dark blue line representing mortgage payment ratio maintained a stable range between 21% and 23% throughout the period.

- The housing market experienced a brief period of improved mortgage affordability because home prices decreased during the 2007–2009 housing bust. Rent stayed stable.

- 2010s: Renting and buying were both affordable, with only a small gap between the two.

- The housing market became less affordable because home prices increased while interest rates rose which limited homebuyers' ability to obtain mortgages during the period from 2021 through 2024. Households spent more than 35% of their income on mortgage payments during 2023–2024 but rental costs remained within their typical historical range of 25%.

The rental costs today represent the biggest difference between renting and owning a home since the beginning of modern housing.

San Diego Rent Vs. Mortgage — The main factors that explain why renting costs more than owning a home.

San Diego Rent Vs. Mortgage — The main factors that explain why renting costs more than owning a home.

The current substantial economic gap between nations stems from multiple structural elements together with economic factors.

- High Interest Rates – The mortgage rates experienced a significant increase from 2021 to 2023 which resulted in a 40–60% increase in monthly payments throughout various metropolitan areas.

- Elevated Home Prices – Home values surged over the pandemic era. The prices continue to stay at record levels even though the growth rate will be slower during 2024–2025.

- The total cost of homeownership exceeds mortgage payments because it includes annual expenses for property taxes and insurance and HOA fees and maintenance costs which amount to thousands of dollars.

- The rental market experienced new apartment development growth from 2023 to 2025 which resulted in controlled rent increases across various metropolitan areas.

The rental market received positive effects from rising supply levels and shifting demand patterns yet homebuyers encountered rising property costs and expensive mortgage terms.

Implications for Renters, Buyers and Property Investors

For Renters

- Renting is cheaper and more flexible than buying.

- The funds saved from housing costs allow people to purchase new assets while they build retirement funds or work on debt repayment.

- The rental market offers premium housing solutions to families who want to avoid buying a home and its related mortgage payments.

For Buyers

- Higher entry requirements function as obstacles which block numerous people from obtaining mortgage loans.

- The budget constraints of qualified families make it difficult for them to afford housing while forcing them to choose between different living arrangements.

For Investors

- The increasing rental market demand results in higher occupancy rates and stronger rent increases which affect family-sized units the most.

- The affordability gap leads investors to view rental housing as a more attractive long-term investment opportunity.

Risks & Caveats for 2026

The present market pattern which demonstrates renting as a more budget-friendly choice will probably undergo modifications in upcoming years.

- Mortgage rates may fall – The Federal Reserve may cut rates in 2026 which will make home ownership more affordable.

- Rent inflation risk – The rental market faces an increased risk of rising prices because of potential supply shortages and increased migration activity.

- Regional variation – Affordability differs widely. The cost of living in coastal metropolitan areas such as San Diego and Los Angeles and New York City exceeds that of cities located in the Midwest and Southern regions.

Final Thoughts

The rental market will stay more affordable than home ownership during the next few years. The Goldman Sachs data shows that renters spend 25% of their income on housing yet homebuyers need to spend more than 35% of their earnings for housing expenses.

The fact that homeownership does not work for everyone does not indicate that it is a negative experience. The ability to create wealth through time spans is made possible by equity functions. The current market conditions lead many families to rent their homes because they prefer to wait for housing prices to decrease.

Households extending their rental stays will create ongoing demand for family-friendly housing units which benefits landlords and investors through business opportunities.

FAQ: Rental vs Mortgage Affordability 2025–2026

The present market environment provides better rental options than property ownership according to current market conditions.

A1: High mortgage rates and home prices have pushed ownership costs well above rent in most U.S. metros.

The cost of owning a home surpasses renting by a total of $1,300 per month.

The cost of mortgage payments in numerous urban areas exceeds the typical rent prices for equivalent housing by 60–90 percent.

Q3: Will this trend last?

The current market conditions will continue until 2026 unless mortgage rates decrease substantially or home prices experience a decline.

Q4: Does renting mean I’ll never build equity?

A4: Renting doesn’t build equity, but savings from renting can be reinvested into other wealth-building assets.

Q5: What effects does this have on property investors?

The increase in ownership expenses drives more families to rent their homes which leads to rising rental costs for property owners.

Contact Realty Management Group

Have questions about pricing, marketing, or strategy in today’s rent-vs-own landscape? Our San Diego team can help.